Amidst the trade war and tariff threats that dominated news headlines in the first half of 2025, financial markets have paid increased attention to the outlook for the U.S. Dollar and – closely related – foreign demand for U.S. bonds and stocks. The release of the Treasury International Capital (“TIC”) report for the month of April provided an initial checkpoint for market participants to judge whether foreigners are turning their back on U.S. securities. Following several years of very strong overseas demand – particularly for equities, as U.S. companies offered the most compelling returns – demand might slow this year. However, there are few signs that foreign investors are selling large amounts of U.S. securities thus far.

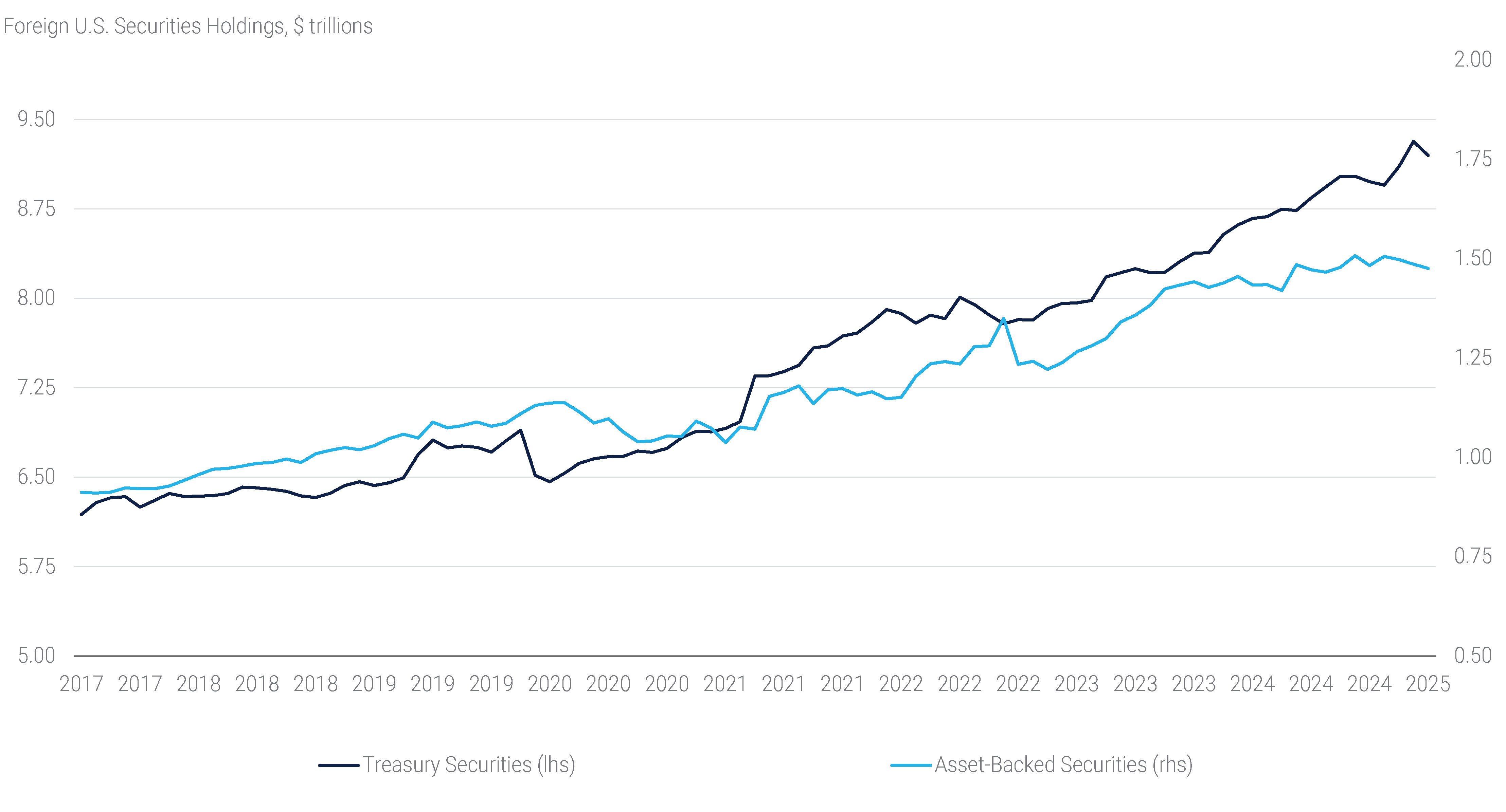

The April TIC report was perhaps the most widely anticipated report to gauge short-term foreign demand trends. The report tracks international transactions in and holdings of U.S. securities and showed some weakness in April, but ultimately did not change recent trends meaningfully. Foreigners sold an estimated $138 billion across Treasuries and Agency MBS,(3) the largest monthly holdings decline across the two categories since November 2022. While sizeable for a single month, the outflows were modest relative to the strong inflows earlier in 2025, as February and March saw an estimated $345 billion in combined purchases from foreigners. In addition, nearly half of the Treasury holdings decline came from Canada, which shed an estimated $63 billion during the month, but had also been the major buyer of Treasuries in February and March. Despite the April decline, the foreign holdings of Treasuries and Agency MBS remain near their all-time highs (see panel 3).

Panel 3:

Foreign Holdings of U.S. Income Securities Remain High

Outside of the monthly volatility, continued weakness from certain jurisdictions, like China and Japan, historically two of the largest holders of U.S. Treasury securities and Agency MBS, was arguably more notable. According to our estimates,(3) China and Japan have seen notable declines in their holdings over the past year, shedding an estimated $179 billion of Treasuries and Agency MBS combined. This represents roughly 7% of their combined holdings. While the declines are occurring simultaneously, they are likely driven by different motivations. For Japanese investors, rising FX hedging costs have made U.S. assets unattractive in recent years, likely leading them to let holdings mature, while reinvesting in better-yielding alternatives. In contrast, China has been actively altering its reserve management practices and has shifted towards third-party custodians. For example, it may be the worst kept secret among data watchers that increases in Belgian holdings of Treasuries have been driven by China shifting reserve holdings to European domiciled custodians such as Euroclear, in turn obfuscating the ultimate holding jurisdiction. Moreover, over the past year, holdings in Belgium have grown more than holdings in China have declined.

Meanwhile, foreign account participation at Treasury auctions has slowed in recent years. Treasury auction participation data paints a picture of lukewarm foreign demand at auctions. The foreign purchase share at U.S. Treasury coupon auctions has declined to roughly 6% of gross Treasury issuance, roughly half of the average purchases seen in 2021 and the first half of 2022. Despite the decline in demand at Treasury note and bond auctions, auction demand for bills has improved, reaching the highest relative share in 10 years at roughly 12.5%.

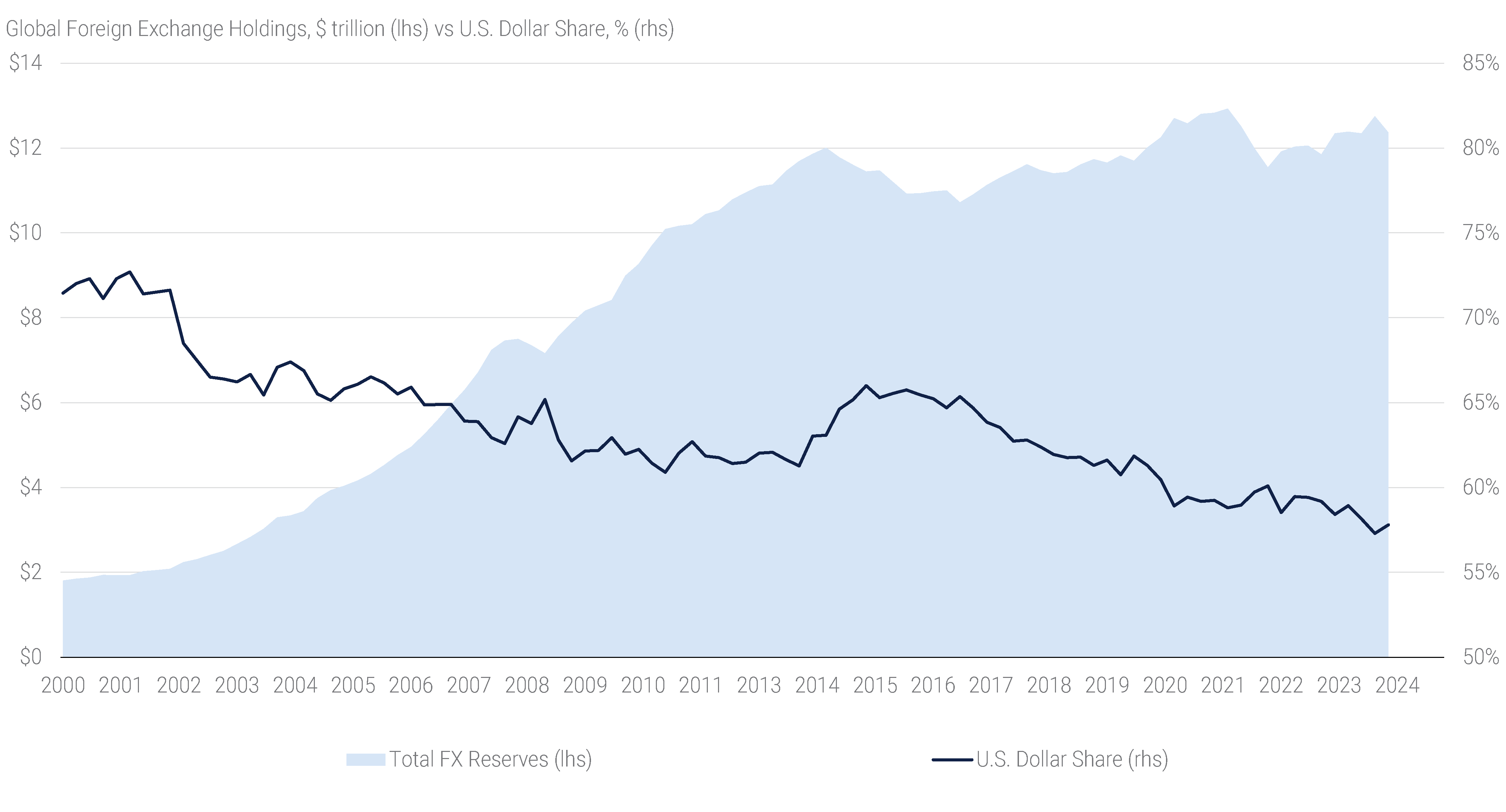

A related dimension in the foreign demand picture has been the currency allocation decisions of reserve managers. Foreign exchange reserves have stood at around $12 trillion for several years now according to the International Monetary Fund, with roughly three-fifths of these exchange reserves being held in U.S. Dollars (see panel 4).

Panel 4:

The U.S. Dollar Share of Global FX Reserves Has Declined Gradually

A modest reallocation away from the U.S. Dollar could result in sizeable flows. For example, if reserve managers were to reallocate 2% of their holdings away from the U.S. Dollar, it would result in roughly $250 billion less demand for U.S. securities, an amount that if invested in U.S. Treasuries could fund more than 10% of the current budget deficit. Ultimately, diversification away from the U.S. Dollar will be determined by global trade flows and whether other jurisdictions can offer assets attractive to reserve managers, which has been one of the largest impediments to past diversification efforts.

Overall, a shift in foreign demand for U.S. fixed income and equity securities will likely be a slow-moving development if it comes to fruition. For now, it appears that fears over sizeable short-term sales from overseas accounts to the U.S. Dollar holdings are overblown. A good part of the explanation is that sudden shifts would force foreign investors to realize losses on their portfolios and that there are simply few attractive alternatives in which to allocate holdings. However, similar to the reserve manager reallocation, a slow-moving shift out of the U.S. Dollar could still be impactful over time. Treasury and Agency MBS markets have faced large supply and narrow investor bases in recent years, which have contributed to elevated spread and rate volatility. Maintaining a broad buyer base that includes international investment would therefore be beneficial, if not necessary.