Ahead of the dog days of summer,(1) market attention centered around three developments during the month of July:

- Passage of the One Big Beautiful Bill Act ("OBBBA"),

- The pressure campaign on the Federal Reserve ("Fed") to cut interest rates, and

- Trade negotiations ahead of the Administration's August deadlines.

Ultimately, the Administration made significant progress on nearly all initiatives, passing the OBBBA faster than most observers had anticipated and inking bilateral trade deals with the European Union and Japan, amongst other countries.

Economic Growth and Labor Market

According to the initial estimate from the Bureau of Economic Analysis (“BEA”), the U.S. economy expanded by a 3.0% seasonally adjusted annualized growth rate (“SAAR”) in Q2, bringing the GDP growth rate in the first half of 2025 to 1.2% SAAR after GDP contracted by 0.5% SAAR in the first quarter. The rebound was driven by an improvement in consumer spending (1.4% SAAR in Q2) and net trade. That said, consumers remain more cautious than in recent years, as spending ran at roughly one-third of last year’s pace in the first half of 2025.

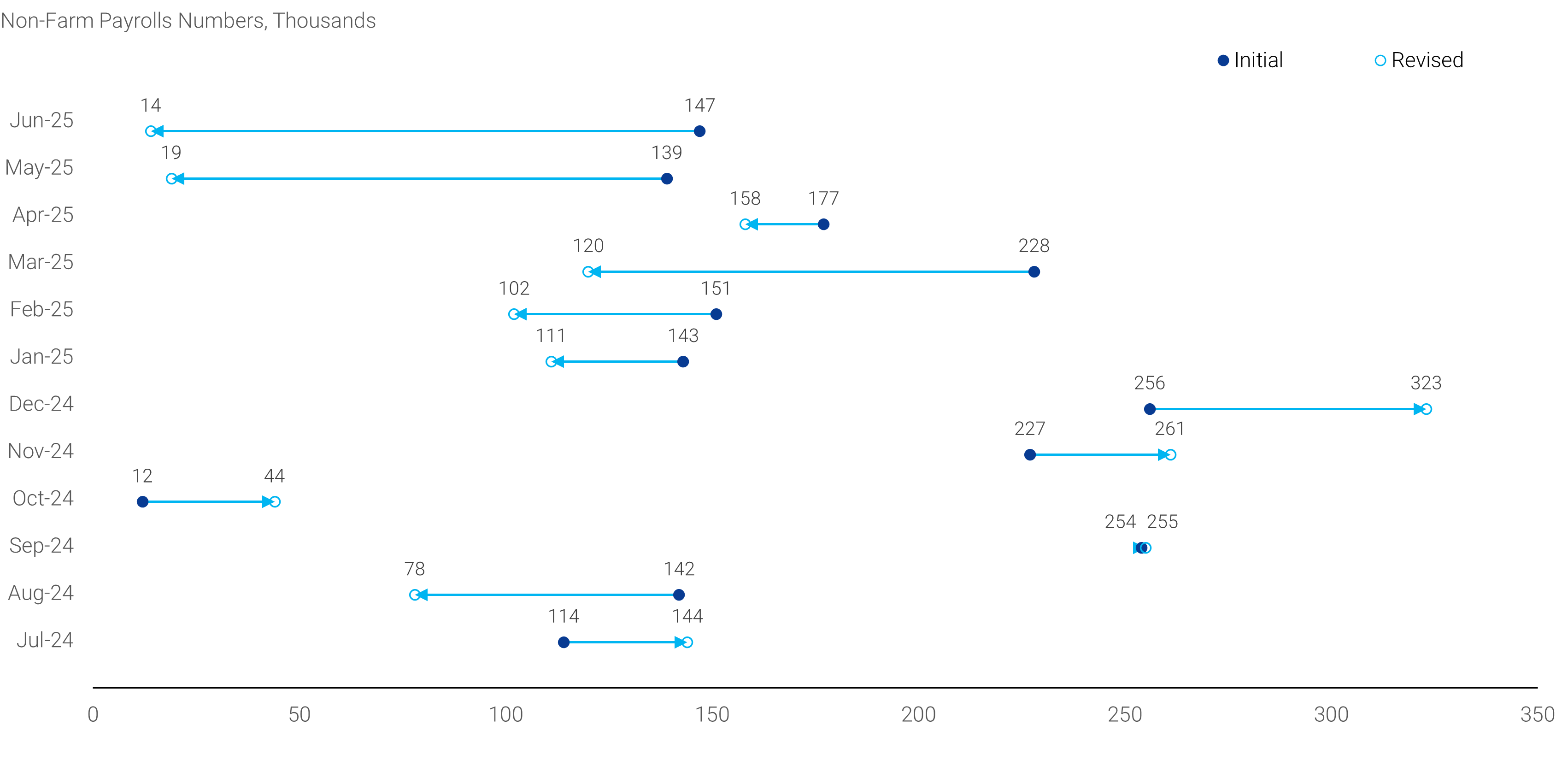

One factor contributing to the more cautious consumer might be the labor market, which remains in a stasis of low hiring and firing. While labor supply and demand remain broadly in balance, hiring has slowed more meaningfully than expected. The Bureau of Labor Statistics significantly revised earlier months’ hiring in the July non-farm payrolls report (“NFP Report”), bringing the 3-month average pace of job gains down to 35,000 from 125,000 (see panel 1), driven largely by hiring in healthcare and social assistance.(2)

Panel 1:

Revisions to Prior Months' NFP Reports Reveal a Different Picture of the Job Market

Despite the degradation in the headline employment statistics, the unemployment rate remains little changed at a historically low level of 4.2%. Of note, the unemployment rate would likely have risen more meaningfully in recent months absent a shrinking labor force, which has declined by nearly 800,000 individuals since May.

Despite the degradation in the headline employment statistics, the unemployment rate remains little changed at a historically low level of 4.2%. Of note, the unemployment rate would likely have risen more meaningfully in recent months absent a shrinking labor force, which has declined by nearly 800,000 individuals since May.

Inflation

The June inflation report showed early signs of tariff-related price pressures that are starting to be passed on to the consumer. According to the BEA’s June Personal Consumption Expenditures (“PCE”) report, core PCE inflation came in at 0.3% month-over-month, in turn pushing the annual rate back to 2.8% year-over-year. Financial services inflation remains the hottest service sector in the PCE, while most other services continue to moderate. More notably, goods inflation firmed in June, bringing goods prices excluding energy, food, and used cars to 2.0% SAAR over the last three months. While still a moderate price gain, the details of the report showed that prices were particularly firm for goods which are primarily imported. Moreover, this also suggests that prices could rise further as tariffs rates are expected to increase in coming months. Thus, the effect of tariffs on price increases remains the key watchpoint for both the Administration and the Fed. For the time being, we expect that modest near-term pricing pressures in goods can be offset by a moderation in services, but the uncertainty around the impact of inflation remains high.

Housing Market

Economic data also indicated that housing market activity was further subdued in June as persistently high mortgage rates, as well as increased property taxes and insurance premiums, continue to present a burden for potential home buyers. Existing home sales remained depressed at 3.9 million annualized units in June, while new home sales improved only marginally from a more pronounced decline in May. The combination of slowing buyer demand and steadily expanding supply continued to weigh on home prices. For example, Zillow data suggests national home prices declined a fourth consecutive month in June and are running modestly negative on a year-to-date basis. Furthermore, the price premium for new homes has disappeared with the median new home selling for almost $40k less than the median existing home. Additionally, the recent softness suggests that builder incentives such as mortgage rate buy downs, price cuts, upgrades, and closing cost assistance are becoming less effective in a prolonged environment of strained affordability.

Financial Markets

Financial markets continued to be constructive in July and priced an increasingly optimistic outlook for the economy by the end of the month. Treasury yields sold off modestly, while the yield curve flattened amid a shifting Treasury issuance outlook and a steadfast Fed. Of note, a portion of the July price action has reversed following the end of the month as the weaker-than-expected July NFP Report has raised questions about the trajectory of the labor market.

Federal Reserve and Interest Rates

2-year Treasury notes were volatile around the end of July given a shifting near-term Fed outlook and more issuance in the front end of the curve. Overall, yields were little changed between the end of June and August 1

st, though the snapshot belies a more meaningful selloff in July and a subsequent repricing after the latest NFP Report. In similar fashion, after briefly pricing as little as 33 basis points (“bps”) of cuts in 2025, markets have gone back to pricing more than two 25 bps cuts for the remainder of the year. Meanwhile, long-term Treasury yields have been more muted than short-term yields, leading the yield curve to flatten. As of July month-end, the yield differential between 2- and 10-year Treasury notes fell to 42 bps, the lowest levels since before the April 2

nd tariff announcements.

Meanwhile, the Fed held policy rates unchanged for a fifth consecutive time at the July Federal Open Market Committee (“FOMC”) meeting, despite increased pressure from the Administration. Amid an uncertain outlook for price stability, a majority of FOMC members(3) agreed with Fed Chair Powell’s assessment that the economy is doing sufficiently well to maintain rates at current levels. This patient approach gives the Committee time to assess the impact of tariff policy changes on the economy going forward. With one more labor market report and two additional inflation readings due before the September meeting, the FOMC will have more information in hand to help determine whether a rate cut is warranted.

The Administration’s campaign for the Fed to lower interest rates has been an important market narrative in July. While there have been plenty of historical episodes of political pressure on the Fed, the risks of losing central bank independence have increased in part because recent changes to Treasury debt management stand to benefit significantly from lower monetary policy rates. With rising risks of “fiscal dominance” and a close tie to the Administration, the next Fed Chair could face challenges shielding the institution from further outside influence. Fed Chair Powell and the broader FOMC have faced criticism for having made suboptimal policy choices at times in recent years, most notably the characterization of inflation as “transitory” in 2021; however, the FOMC has helped sustain a functioning economy that has been the envy of the world in an environment of elevated interest rates. Over the long term, investors will benefit from a central bank that makes informed and independent decisions to support the labor market and stable prices.

Volatility and Risk Assets

Interest rate volatility continued to normalize, ending July at some of the lowest levels since the beginning of 2022. The ICE Bank of America Move Index, a measure of short-term interest rate volatility across various maturities, has declined to an index level of 79.4 as of the end of July (see panel 2). The decline was driven by the Fed’s patient monetary policy stance and by relatively low realized volatility, which fell to its lowest levels since January.

Panel 2:

Interest Rate Volatility Has Declined to Lowest Level Since 2022

Meanwhile, risk assets performed well for another month, with the S&P 500 generating a 2.2% total return in July, which represented the third consecutive positive monthly return. Economic resilience, robust corporate earnings, general optimism about the passage of tax reform, and prospects of deregulation continued to drive the strong stock market performance. Outside of equities, cryptocurrencies also performed well in July as Congressional action on stablecoins, including enactment of the Genius Act, boosted the industry. Corporate bonds benefitted from the robust risk sentiment as the Bloomberg U.S. Aggregate Corporate Bond Index generated a 0.56% excess return during the month. Agency MBS spreads were little changed in July, with the Bloomberg U.S. MBS Index excess return coming in at 0.0%. Of note, higher coupons outperformed the index into the selloff in July. Finally, the U.S. Dollar continued its recovery, with the Dollar Index gaining 3.2% during the month and retracing some of its first half underperformance.

Markets Are More Upbeat on the Fiscal Outlook

Rewinding the clock,

market sentiment around the U.S. fiscal outlook was notably negative in April and May, driven by concerns over rising deficits and increased policy uncertainty. However, over the past month, several key developments have helped clarify the picture and improve sentiment. While long-term challenges remain, markets are more constructive on the near-term outlook as a more coherent fiscal strategy has emerged.

The first pillar of that strategy has been finalizing tax reform. Arriving sooner than most observers had expected, President Trump signed the OBBBA into law on July 4th, providing the Administration a major Congressional win and thereby avoiding the potential fiscal cliff that would have come with the failure to extend the 2017 tax cuts. According to Congressional Budget Office estimates, the legislation is expected to increase the deficit by about $3.4 trillion over the next decade, driven primarily by a $4.5 trillion drop in federal revenues and partially offset by $1.1 trillion in planned spending cuts. On the revenue side, the OBBBA extends many provisions from the 2017 Tax Cuts and Jobs Act, while also adding in new tax breaks: an increased standard deduction for seniors, a temporarily higher cap on State and Local Tax (“SALT”) deductions, a more generous child tax credit, and exemptions for tips and overtime pay. Many of these are temporary, so the revenue impact is front-loaded. On the spending side, the cuts are mostly delayed, with key reductions to Medicaid and SNAP not taking effect until 2028. Therefore, the government is taking a “spend now, pay later” approach, with the bill providing near-term stimulus balanced by spending cuts in the latter half of the 10-year window.

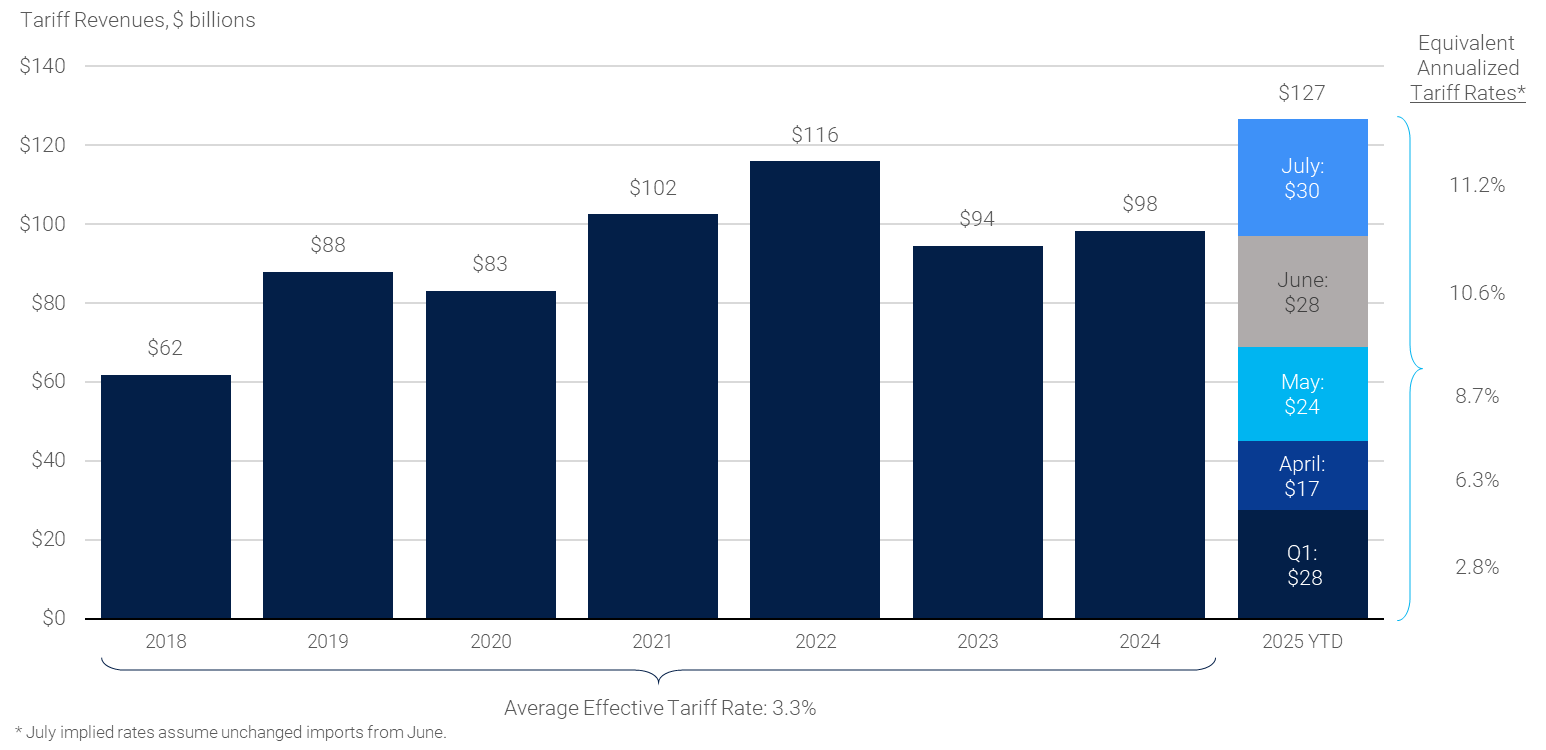

But unlike the projected revenue shortfalls from tax reform, rising tariff revenues have been a second pillar in this strategy. Following several months of negotiations and deadlines, the U.S. reached trade frameworks with several important trading partners in July. The agreements suggest that higher tariffs are likely here to stay, which in turn would raise revenues in coming years. During the trade negotiations, the economy has displayed resilience thus far, in part attributed to the gradual implementation of tariff increases and the surprising restraint shown by major trading partners, who have largely avoided retaliatory measures.

As higher tariff rates have become more established, revenue has been growing steadily (see panel 3). July customs collections hit $29.6 billion according to the U.S. Treasury, bringing the year-to-date total to $127 billion, the highest in more than a decade. At the current tariff rates, the U.S. Treasury could collect well over $300 billion in customs revenue per year, which does a lot of work to close the projected revenue shortfall. While this does not plug the entire fiscal gap from the tax bill, it is a meaningful source of revenue, and more than markets had expected just months ago.

Panel 3:

Tariff Revenues and Effective Rates Have Been Rising Swiftly

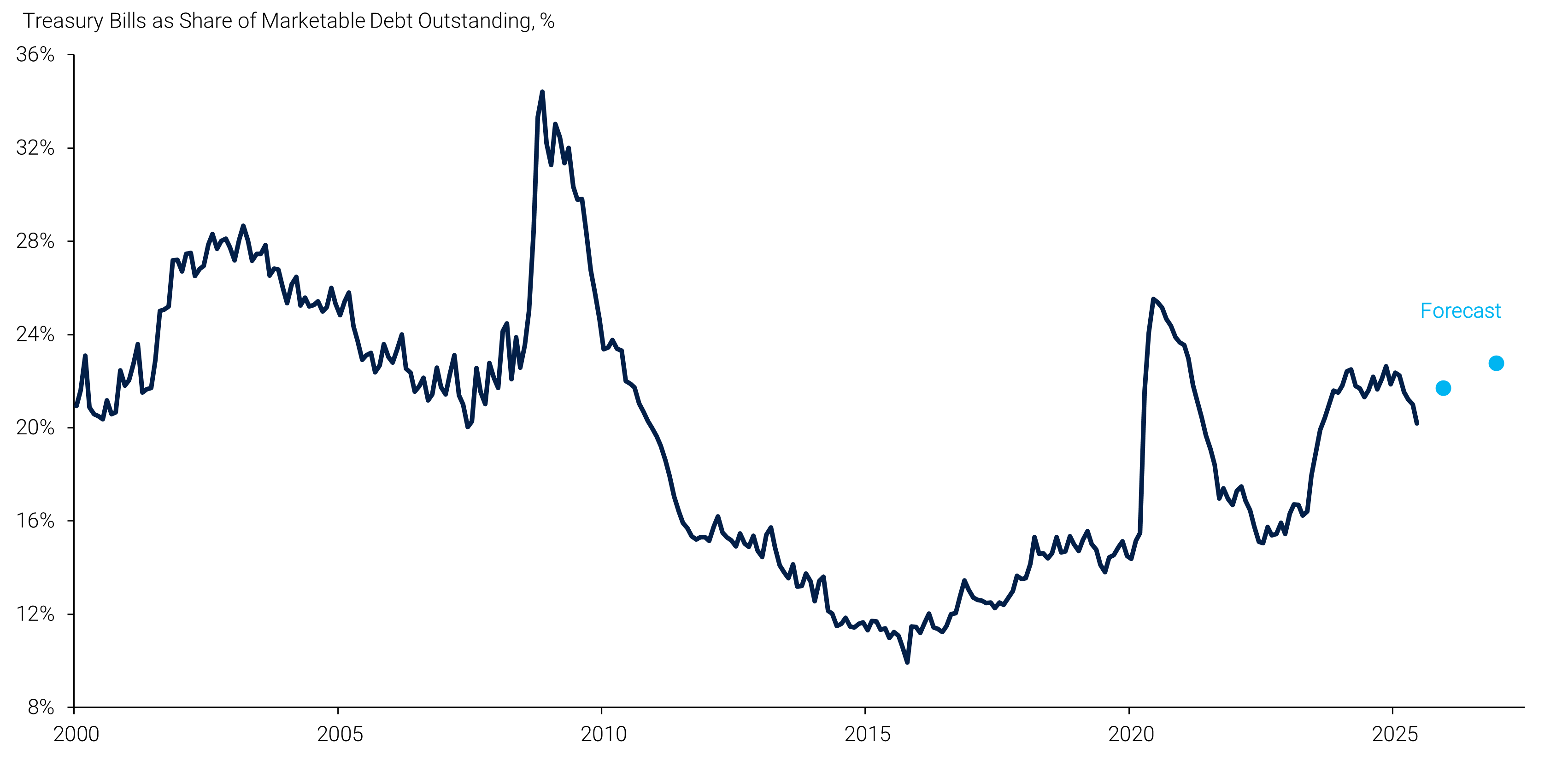

As a third pillar, the U.S. Treasury plans to fund this evolving fiscal strategy with short-term borrowings instead of terming out the debt, as many market participants had assumed and as Treasury Secretary Bessent has suggested in the past. Earlier in July, Secretary Bessent indicated he would prefer to wait until interest rates come down before increasing longer-duration issuance. Historically, Treasury Bills (“Bills”) have made up less than 25% of total Treasury debt (see panel 4), as a heavier reliance on Bills increases rollover risk and requires the U.S. Treasury to hold more cash as a buffer in the event of market disruptions. Fortunately, there appears to be growing demand for front-end Treasury paper. Money market fund assets are still climbing, and there are indications that once the Fed’s Quantitative Tightening ends, the U.S. Treasury will let mortgage-backed security holdings continue to roll off and reinvest the proceeds into Bills. Growth in stablecoins has also added marginal demand for short-term, high-quality collateral. Together, these factors have allowed the U.S. Treasury to lean more heavily on Bills without causing stress in funding markets or having to increase longer-term issuance.

Panel 4:

Treasury Bill Issuance Will Increase the Share of Short-Term Debt to the Highest in Years

These dynamics have helped to ease pressure in long-end rates in July. Term premium, which had risen sharply earlier this year, has declined modestly. Investors seem more comfortable with the near-term deficit outlook, especially given the stronger-than-expected revenue collections and the absence of a funding cliff. Long-term questions remain—particularly about the sustainability of debt, trade policy, and global responses— but markets appear to have regained some footing for now.